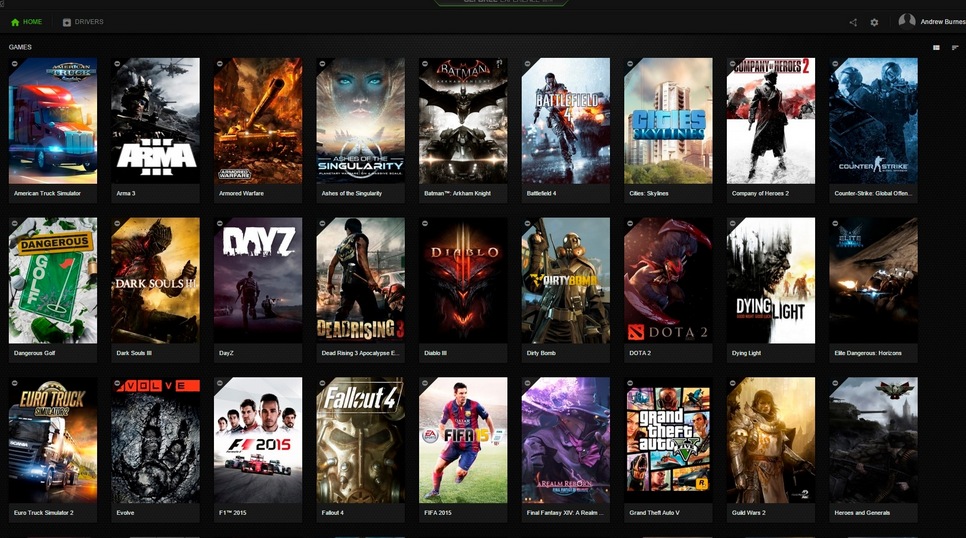

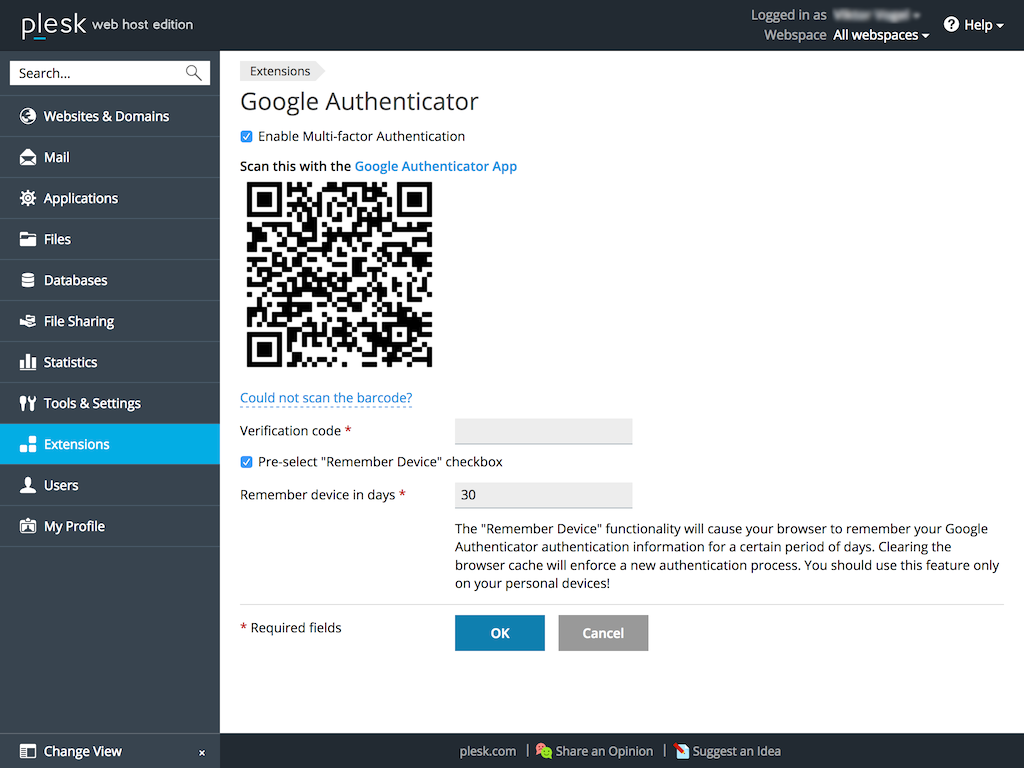

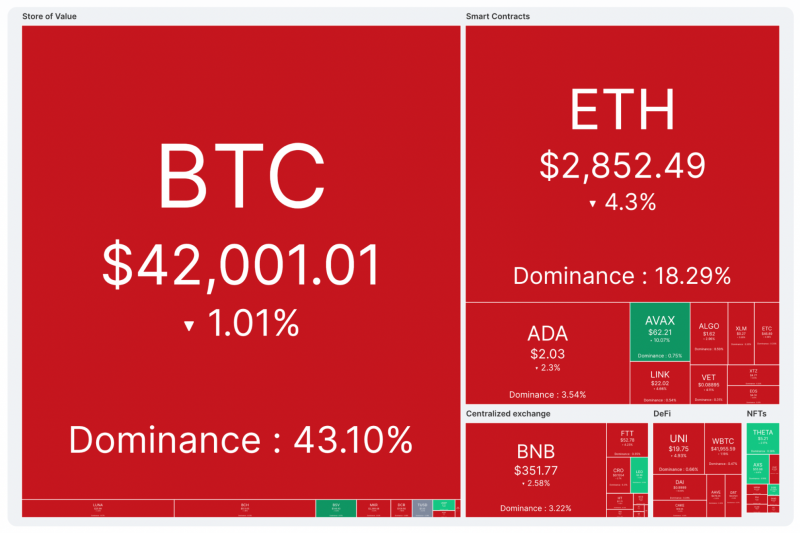

Bitcoin continued to plummet from Monday to Wednesday’s deadline, with a seven-day drop of more than 11%; according to CoinMarketCap data, the global cryptocurrency market value has dropped from 2.1 trillion to 1.8 trillion U.S. dollars, disappearing 300 billion U.S. dollars in just two days. . The reason for the big drop, I think, has something to do with the psychological barrier of 50,000 US dollars, because Bitcoin also plummeted 19% in just one hour on the 7th of this month. However, the two big drops were when the price of Bitcoin was close to 50,000 US dollars.

In addition, another larger plunge factor is reflected in the financial turmoil derived from China's

Evergrande Group; although Bitcoin is not a traditional financial market, it has a positive correlation with Nasdaq 100 index futures in the past month, which means that when the United States Bitcoin will also be affected when technology stocks fall. (Extended reading: The Wall Street Journal” Why did Bitcoin stop when it rose to $50,000?)

Evergrande Group; although Bitcoin is not a traditional financial market, it has a positive correlation with Nasdaq 100 index futures in the past month, which means that when the United States Bitcoin will also be affected when technology stocks fall. (Extended reading: The Wall Street Journal” Why did Bitcoin stop when it rose to $50,000?)

[Start LINE push broadcast] Daily important news notification

Evergrande Group’s debt reversal, such news that shocked the market, can’t find the latest information on China’s official media People’s website? ! Obviously, Chinese regulators are unlikely to save this mess, which makes Chinese netizens frustrated; since no one is here to take the order, perhaps Bitcoin can be a means to resist the shock? Such remarks were reposted by many Chinese netizens. (Extended reading: Understanding the Evergrande crisis in one article: Facing a moment of life and death this week? Will it become the “Chinese version of Lehman Brothers”?)

Evergrande Group’s search results on the Chinese Communist Party’s official media People’s Daily Online (Photo/People’s Daily Online)

Evergrande Group’s search results on the Chinese Communist Party’s official media People’s Daily Online (Photo/People’s Daily Online)

Evergrande is one of the world’s largest real estate companies, listed in Hong Kong (code: 3333.HK); however, Evergrande has used policy-oriented and highly leveraged capital to make huge profits for many years, and its company’s asset-liability leverage ratio exceeds the standard, which is China’s compliance The high leverage ratio caused Evergrande’s cash to burn out, triggering a large number of creditor lawsuits. The stock price also fell 60% this year, a four-year low. In fact, as early as July this year, the S&P Credit Rating Index downgraded Evergrande’s rating. Since then, many well-known credit rating agencies have also downgraded Evergrande, including: Moody’s, Fitch and JPMorgan Chase. How will Evergrande influence the Bitcoin market? (Related report: How does the unlimited amount of Ether achieve “deflation”? After the upgrade of Ethereum, what will be the market impact | more articles)

In the cryptocurrency market, the currencies circulating in the real and virtual worlds are stablecoins. The largest stablecoin by market value is the USDT US dollar stablecoin launched by Tether. USDT is the third largest cryptocurrency in the cryptocurrency market by market value, accounting for 686 100 million US dollars, and Tether is headquartered in Hong Kong. Tether’s biggest criticism has always been the value of its actual assets. Tether once stated that they hold a large number of listed companies’ securities, real estate, gold, cash, etc., but the detailed information is unwilling to disclose; however, the foreign media reported last Sunday. After half of the USDT assets pledged by Tether came from bonds, the price of USDT fluctuated the most in three months, and then the price stabilized at the price of 1:1 USD stablecoin within one day.

Although it is impossible to confirm whether Tether holds a large amount of Evergrande bonds, this news still shakes many people’s confidence in USDT. I am a frequent visitor to USDT, and I also know that USDT has serious credit problems, but because USDT has the largest circulation, it is the most convenient to circulate in various exchanges. Using USDT also does not have to worry about the problem of cryptocurrency premiums. Therefore, among many benefits, I USDT is still commonly used. Since 2017, Tether has been found to have printed money for no reason many times, and well-known accounting firms have also refused to endorse Tether. Especially in 2018, there were many rumors that Tether was about to go bankrupt, although USDT remained standing after various crises. Don’t shake it, but I still think that USDT is just too big to fail, not really supportive. For me, USDT is suitable for use as a cryptocurrency tool for withdrawal, deposit, and transfer. If you want to store stablecoins for a long time, USDC launched by Circle, USDP launched by Pax or BUSD from Binance all have more stable currency reserves. assets. Returning to the views of Chinese netizens on Evergrande, in order to save the financial crisis brought about by Evergrande, Chinese netizens expect the government to suppress Bitcoin and the U.S. dollar through digital renminbi and securities, and even destroy Tether/USDT to force the depreciation of the U.S. dollar. This method is not groundless. As the CCP continues to use digital renminbi to suppress Bitcoin, those who can use Bitcoin have already left. Netizens who stayed in China’s currency circle have long returned to the general financial stock market. If the CCP agrees, it may raise the price of Bitcoin to make up for the breach, and then smash it all back to restore market liquidity; regardless of whether the CCP rescues Evergrande, USDT and Bitcoin may become storms. It is recommended that investors convert stable currency tools to cryptocurrency tools other than USDT; invest in Bitcoin in units of more than five years.

[Start LINE push broadcast] Daily important news notification

We regularly hold [Teach me to buy Bitcoin] online activities, the purpose is to allow the public to correctly understand the industry knowledge and avoid being deceived! Friends from all over the world are welcome to join in the grand event. In the event, we will take everyone to learn about Bitcoin, explain market trends, and share recent common scams, and finally teach you how to buy Bitcoin in a safe way! Welcome to click on the link to sign up!

Bitcoin September related data. (Photo/Li Keren)

Bitcoin September related data. (Photo/Li Keren)

The author is a long-term Bitcoin holder (Hodl). Joined the currency circle in 2017 as the co-founder of Xinbei Mine; joined Wanbao Weekly as a cryptocurrency columnist in the same year; joined a well-known blockchain startup technology company in 2018 as a marketing and public relations position; in 2020, the largest cryptocurrency in Quanqiu The exchange Binance Binance cooperates to hold regular Bitcoin seminars.

恒大风暴连累比特币狂跌?USDT稳定币恐成缓冲沙包,跳车的时候到了?

从周一到周三截止,比特币继续暴跌,7天跌幅超过11%;据CoinMarketCap数据显示,全球加密货币市值从2.1万亿美元跌至1.8万亿美元,短短两天就蒸发了3000亿美元。 .之所以大跌,我认为与5万美元的心理关口有关,因为比特币在本月7日的短短一小时内也暴跌了19%。然而,两次大跌是在比特币价格接近 50,000 美元的时候。 .此外,另一个更大的暴跌因素体现在来自中国恒大集团的金融风暴;比特币虽然不是传统金融市场,但在过去一个月与纳斯达克 100 指数期货呈正相关,这意味着美国比特币何时会在科技股下跌时受到影响。 (延伸阅读:《华尔街日报》“为什么比特币涨到 50,000 美元就停止了?)

【开始LINE推送】每日重要新闻通知

恒大集团债务逆转,这样震惊市场的消息,在中国官媒人民网查不到最新消息? !显然,中国监管机构不太可能挽救这个烂摊子,这让中国网民感到沮丧;既然没有人来接单,或许比特币可以成为抵御冲击的一种手段?不少中国网友纷纷转发此番言论。 (延伸阅读:一篇文章理解恒大危机:本周面临生死关头?会不会成为“中国版雷曼兄弟”?)

恒大集团在中共官方媒体人民网的搜索结果(图/人民网)

恒大集团在中共官方媒体人民网的搜索结果(图/人民网)

恒大是全球最大的房地产公司之一,在香港上市(代码:3333.HK);然而,恒大多年来利用政策性、高杠杆的资本赚取巨额利润,其公司资产负债杠杆率超标,是中国的合规。债权人诉讼的数量。股价今年也下跌了 60%,创四年新低。事实上,早在今年7月,标普信用评级指数就下调了恒大的评级。此后,多家知名信用评级机构也纷纷下调恒大评级,包括:穆迪、惠誉和摩根大通。恒大将如何影响比特币市场? (相关报道:无限量的Ether如何实现“通货紧缩”?以太坊升级后对市场会有什么影响|更多文章)

在加密货币市场中,现实世界和虚拟世界中流通的货币都是稳定币。市值最大的稳定币是 Tether 推出的 USDT 美元稳定币。 USDT是加密货币市场中市值第三大的加密货币,占6.86亿美元,Tether总部位于香港。 Tether 最大的批评一直是其实际资产的价值。 Tether曾表示,其持有大量上市公司的证券、房地产、黄金、现金等,但不愿透露详细信息;然而,外媒上周日报道。在Tether质押的USDT资产有一半来自债券后,USDT的价格出现了三个月来最大的波动,随后一天内价格稳定在1:1美元的稳定币价格上。

虽然无法确认Tether是否持有大量恒大债券,但这个消息还是动摇了很多人对USDT的信心。我是USDT的常客,也知道USDT存在严重的信用问题,但是因为USDT流通量最大,所以在各个交易所流通最方便。使用USDT也不必担心加密货币溢价的问题。所以,在众多的好处中,我还是比较常用的USDT。 2017年以来,Tether多次被发现无故印钞,知名会计师事务所也拒绝代言Tether。尤其是在2018年,虽然USDT在历经各种危机后依然屹立不倒,但Tether即将破产的传言甚嚣尘上。不要动摇它,但我仍然认为USDT太大而不能倒闭,并不是真正的支持。对我而言,USDT 适合用作提款、存款和转账的加密货币工具。如果你想长期存放稳定币,Circle推出的USDC、Pax推出的USDP或Binance的BUSD都有更稳定的货币储备。资产。回到中国网民对恒大的看法,为了挽救恒大带来的金融危机,中国网民期待政府